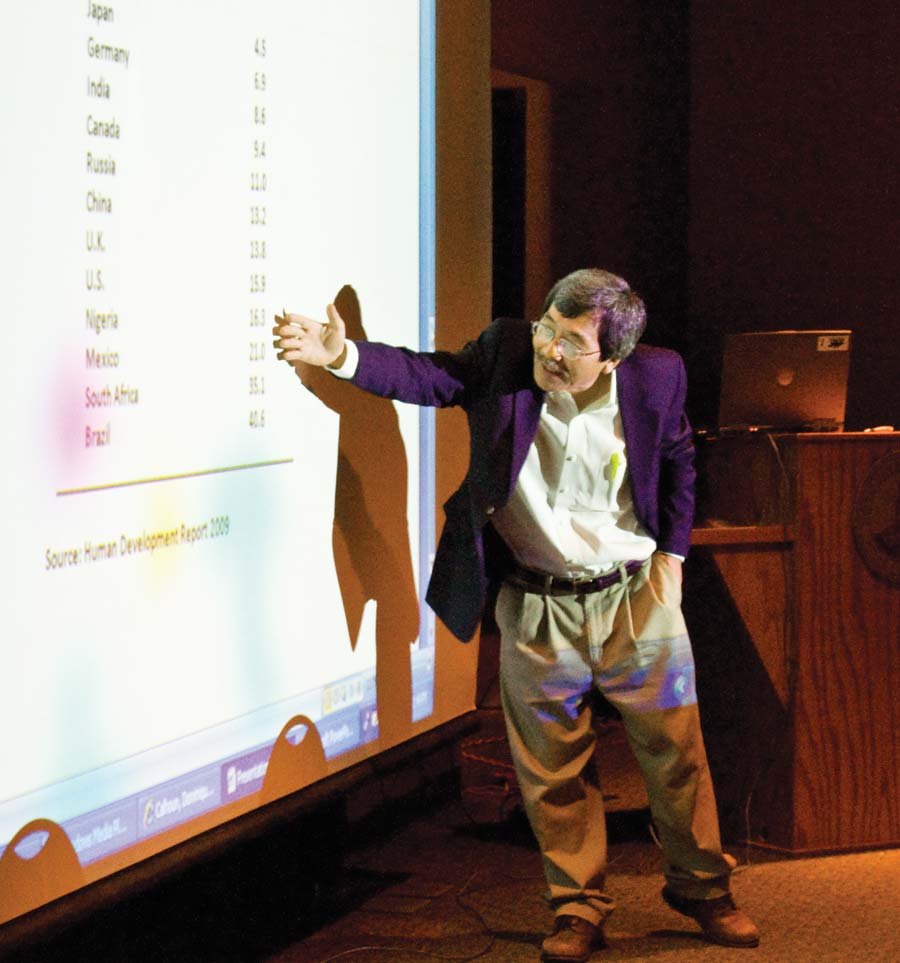

Students are obviously interested in the economy – 100 students attended The Wealth Gap in America presentation Wednesday, hosted by Multicultural Services.

Dr. Michael Preda, professor of political science, and Dr. Yoshi Fukasawa, economics chair, covered the political and economical aspects of the wealth gap, respectively.

“I enjoyed the opportunity to share my thoughts on an important social issue such as a widening gap in wealth with so many students and community members,” Fukasawa said. “I hope that students saw how the widening wealth gap can be analyzed by two distinct disciplines such as economics and political science and how they are related.”

The presentation discussed the national debt issues, how the United States can reduce its debt and the consequences of reducing the national economy.

“This is a very important issue, not only for this particular generation but also the future generations to come,” Fukasawa said.

The national debt is a cumulative sum of a long-running deficit.

Debt comes from the country spending more than it takes in annually.

“Problem is, when the economy is growing fast, we should cut back but don’t,” Fukasawa said. “That is why we continue to have a deficit.”

Reduce the national debt, a country has two options: cut back on spending or raise taxes.

“There is no question that we have a national debt but the question is how undesirable is a debt,” Fukasawa said. “To reduce a debt, you have to create a surplus for the country. Then the question becomes, ‘what should we do?’ Now that depends on political inclination.”

Fukasawa then asked, “Should we cut back on the spending when the economy is not doing well? Or should we raise taxes?”

“If we were to raise taxes, whose taxes should we raise?” Fukasawa said. “Some would say raise it on the rich while other say middle class should bear the increase in taxes.”

War and potential conflict cost money, which has affected the U.S. economy.

“If you look at the last 10 years of the deficit, I would say more than 60 percent of it is really a result of our involvement in the war,” Fukasawa said.

Along with the economy, the widening wealth gap in the U.S. was another focus of discussion.

America is experiencing the biggest wealth gap since the 1920s.

Preda defined wealth as the net assets that a family has in the United States.

The median wealth among white households declined 16 percent from $134,000 to $113,000.

African-American households declined from $12,000 to $5,500, a 53 percent drop.

The biggest drop was among Hispanic households with 66 percent, from $18,000 to $6,000.

Whites have 20 times more net worth than Hispanics and African Americans.

“Declining house values were the principal cause of the erosion of household wealth among all groups,” Preda said.

Due to a weakness in the economy and the exportation of jobs to overseas countries, the working middle class has shrunk.

Lack of education has also hurt lower-income Americans, Preda said.

“Job opportunities for unskilled laborers continue to be fewer each year,” Preda said. “Without proper education and training, some lower-income Americans may not find well-paying jobs in the future.”

Students should be concerned about many economic issues when planning to vote in the next elections, Preda said.

According to Preda, the wealth gap affects everyone. Evidence suggests that the rich are getting richer and the poor are getting poorer.

“Due to the nature of the divide in our economy, students can beat the odds and be successful in their career endeavors by graduating from Midwestern,” Preda said. “College graduates are employed at twice the rate than those without a college degree.”

Matt Gilligan • Sep 28, 2011 at 2:32 AM

The Wichitan needs to put more effort forth covering these sorts of events. I would have been very interested in this talk, but had no idea it was even going on.