By Donance Wilkinson

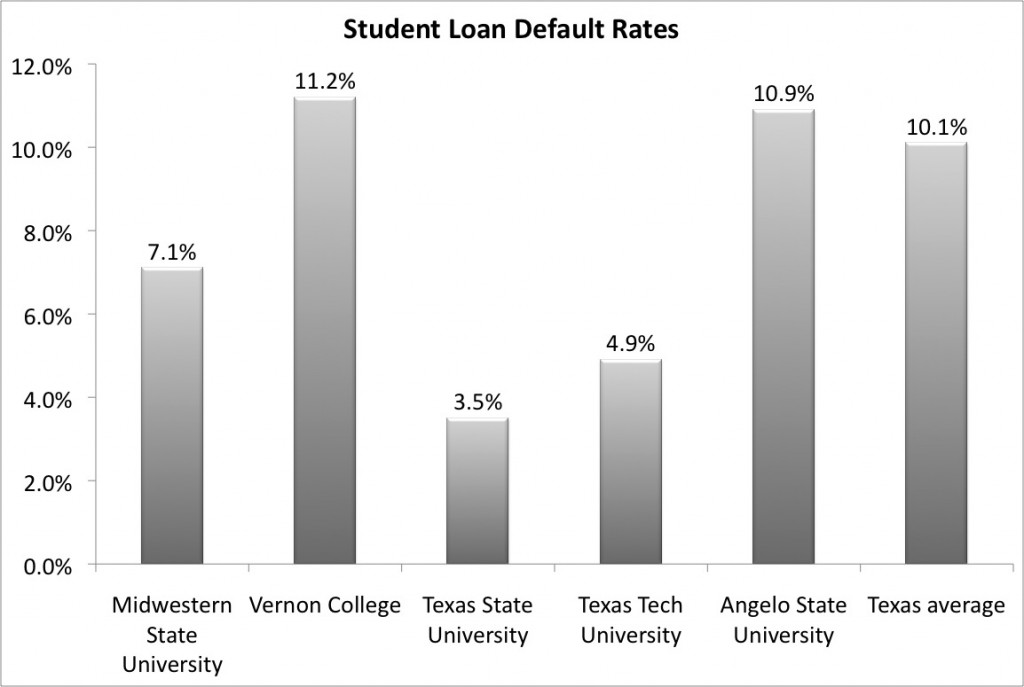

Student loan default rates of MSU students hit 7.1 percent in 2009, brought on by borrowers’ struggles with unemployment in the weak economy.

The default rates for fiscal year 2009—the most recent data released by the Department of Education – show national student loan default rates at a high of 8.8 percent. The last time rates were this high was in 1997.

Texas’ overall state average default rate topped 10.1 percent.

Kathy Pennartz, MSU financial aid director, said the rates will continue to rise because unemployment is the biggest factor in loan defaults. She said student loans, on average, run from $23,000 to $27,000.

She said her office does its best to provide students with alternative repayment options. Students need to take advantage of the services offered by financial aid counselors to prevent an increase in MSU’s default rate and the consequences that come with defaulting, she said.

“Students who default do not realize the jeopardy they put schools in,” Pennartz said. “Their default affects the entire school and the financial aid program for everybody. Schools take defaulting seriously.”

A statement by the National Association of Student Financial Aid Administrators said rates jumped 25 percent—from 7 percent in fiscal year 2008 to 8.8 percent in fiscal year 2009. The FY2009 Cohort Default Rate measures the percentage of students whose first loan repayments came due between Oct. 1, 2008 and Sept. 30, 2009 and who defaulted before Sept. 30, 2010. The CDR has been steadily creeping up from the historic low of 4.5 percent in 2003.

Pennartz said schools with default rates higher than 10 percent for three consecutive years are required to delay Base Financing Rate loan disbursements for beginning freshmen and cannot disburse single-semester loans in one disbursement. Their financial aid offices have to make multiple disbursements in the fall only. Schools with default rates of 25 percent or higher for three consecutive years lose their eligibility in the federal student aid programs.

“There are repercussions but there are options,” Pennartz said. “It’s our mission to help our students avoid delinquency and defaults.” She said the financial aid office does a weekly review of its list of delinquents and calls them to offer assistance.

“When [students] get into situations that are financially strapping, they panic,” Pennartz said. “Most times students do want to pay but they are having problems. When students are experiencing financial difficulty, they should contact a counselor at the financial aid office before defaults reach the danger level.”

Kathi Shilanski, financial aid counselor, said it takes 270 to 360 days to go from delinquent to default on a loan. During that time, a financial aid counselor can help delinquents work on an alternative repayment option to prevent potential default.

Borrowers who are eligible for the deferment option can get a temporary suspension of loan payments. During deferment, no interest is paid on a subsidized loan. For an unsubsidized loan, the borrower is responsible for the interest accrued during deferment.

Borrowers who are not eligible for deferment have the forbearance option, which is a temporary postponement or reduction of payments for a period of time because you are experiencing financial difficulty. The loan holder can grant 12-month forbearance intervals for up to three years. During forbearance, the loan continues to accrue interest while the borrower defaults.

Borrowers who default on their loans are faced with the possibility of having penalties enforced by the Department of Education. These penalties include the garnishing of wages and income tax refunds, having state professional licenses revoked, having holds placed on the students’ transcripts, and students’ losing their eligibility to enroll at any U.S. university.

Before defaulting borrowers can be considered for further financial aid, they must make nine voluntary, on-time, consecutive payments on the loan.

Students can visit finaid.mwsu.edu for general loan repayment information.

Shilanski said a lot of the defaults could be avoided if students would visit the web site or a financial aid counselor for advice about their repayment options. She said the financial aid office provides borrowers with loan repayment information every time they receive a loan.

Default rates listed for other Texas institutions:

• Texas State University, 3.5 percent

• Texas Tech University, 4.9 percent

• West Texas A&M University, 6.5 percent

• Sam Houston State University, 6.8 percent

• University of North Texas, 7 percent

• Texas A&M University, 7.2 percent

• Tarleton State University, 7.5 percent

• Sul Ross State University, 8.8 percent

• Lamar University, 9.5 percent

• Angelo State University, 10.9 percent

• Vernon College, 11.2 percent